- Pascal's Chatbot Q&As

- Posts

- U.S. private investment dwarfs China’s by a massive margin: $109.1 billion vs $9.3 billion in 2024. Nevertheless, China’s Big Fund III is funneling $50–70 billion annually into AI-related subsidies...

U.S. private investment dwarfs China’s by a massive margin: $109.1 billion vs $9.3 billion in 2024. Nevertheless, China’s Big Fund III is funneling $50–70 billion annually into AI-related subsidies...

...particularly for chip manufacturing and training facilities. This results in projections that by 2026, 30–40% of China’s AI compute will be powered by domestic chips.

The Global AI Arms Race: China’s Catch-Up vs America’s Lead in AI Chips and Data Centers

by ChatGPT-4o

The intensifying technological rivalry between China and the United States has reached a critical inflection point in 2025, particularly in the domains of artificial intelligence (AI) chips and data center infrastructure. As global power increasingly hinges on computational might, the article from NextBigFuture provides a timely and revealing comparison of each nation’s capabilities, constraints, and trajectories.

1. U.S. Dominance: Scale, Speed, and Silicon

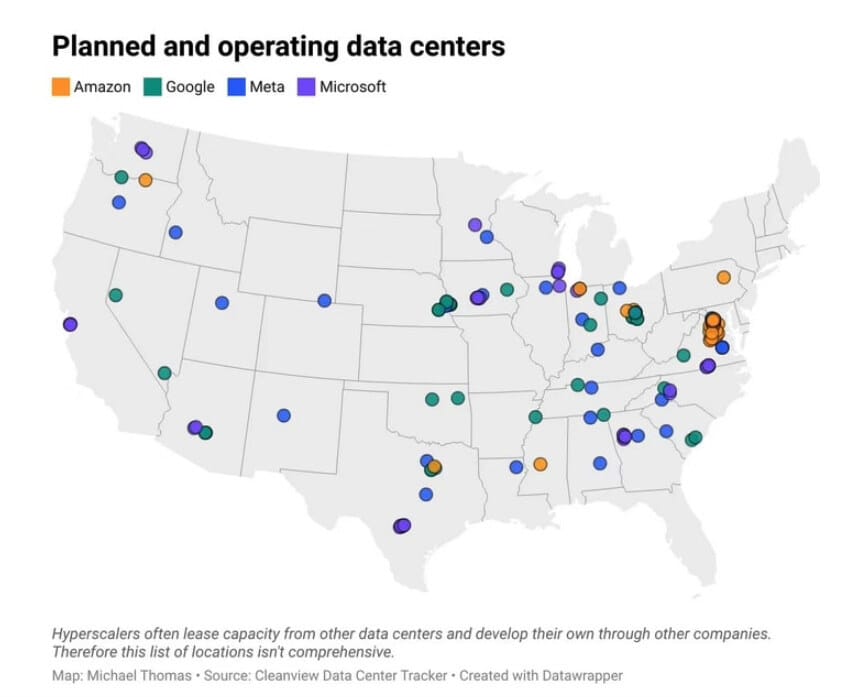

The United States remains the clear front-runner in AI hardware and hyperscale infrastructure. American hyperscalers—such as Google, Amazon, Microsoft, and Meta—are projected to deploy capital expenditures exceeding $400 billion, with the potential to push annual AI investments toward $1 trillion. This war chest is fueled by robust free cash flows, giving U.S. firms strategic autonomy and acceleration capacity in deploying next-generation data centers and acquiring cutting-edge chips like Nvidia’s B200s, which significantly outperform China’s current alternatives.

In contrast, the Nvidia Ruben chips, expected in late 2026, promise to extend this lead further, potentially leaving Chinese systems 100x behind in raw compute performance—a difference translating into a 30–50% AI performance gap. These performance gains directly influence the speed and accuracy of training large-scale models, ultimately dictating leadership in AI development.

2. China’s Catch-Up: Subsidies, Sovereignty, and Strategic Substitution

Despite the gap, China is not idling. It is investing heavily—up to $98 billion in AI capital expenditure in 2025 alone, with $56 billion coming directly from government funding. Chinese tech giants such as Alibaba, Tencent, and Baidu are rapidly rolling out domestic chips, scaling data centers, and replacing banned Western components.

The launch of Alibaba’s PPU chip, built on a 7nm domestic node and competitive with Nvidia’s H100 at ~40% lower cost, marks a milestone in China’s AI self-reliance strategy. Meanwhile, Baidu’s Kunlun P800 cluster, comprising 30,000 AI cards, exemplifies how domestic alternatives like Cambricon’s Siyuan chips are being adopted at hyperscale levels.

Yet structural limitations remain. China’s semiconductor yields (70–80%) lag TSMC’s 90%+, leading to 20–50% cost inflation. Moreover, restricted access to EUV lithography blocks progress beyond 7nm nodes, putting China 3–5 years behind global leaders.

3. Infrastructure Race: Data Centers as the New Digital Arsenal

In terms of physical infrastructure, both nations are expanding rapidly. The U.S. enjoys a head start with more efficient data centers and access to high-performance chips. However, China announced over 500 new data center projects in 2023–2024, in regions like Inner Mongolia and Guangdong, illustrating its intent to scale vertically.

U.S. private investment dwarfs China’s by a massive margin: $109.1 billion vs $9.3 billion in 2024. Nevertheless, China’s Big Fund III is funneling $50–70 billion annuallyinto AI-related subsidies, particularly for chip manufacturing and training facilities.

This results in projections that by 2026, 30–40% of China’s AI compute will be powered by domestic chips, a stark rise from under 10% in 2024. While this signals progress, it underscores how reliant China remains on U.S. innovation pipelines and its ongoing vulnerability to sanctions.

4. Strategic Implications and Long-Term Consequences

This AI hardware divide is more than economic—it has strategic and geopolitical consequences. Compute is now viewed as national infrastructure, underpinning military simulation, biomedical research, autonomous systems, and national surveillance networks.

For the U.S., the current lead allows for proactive standard setting, supply chain control, and global AI influence.

For China, the emphasis is on decoupling, catching up via subsidies, and creating an alternate AI ecosystem that is resilient to U.S. export controls and sanctions.

The article implies that this dual-track development will likely persist: U.S. advances on the bleeding edge, while China fortifies its ability to be a fast follower with scale and cost-effective alternatives.

Conclusion: A Bipolar AI Infrastructure Future

The global AI landscape in 2025 is increasingly bifurcated. While the United States continues to lead in AI chip innovation, data center scale, and private capital investment, China is closing the gap through state-led industrial policy, domestic chip development, and strategic infrastructure deployment.

In essence, this is a race not for immediate parity, but for strategic resilience and long-term independence. The competition is not only about whose AI is faster or smarter—it’s about who controls the future’s compute power, and by extension, the future of knowledge, economy, and security.

Key Stats Summary:

US CapEx for AI: $400B+ in 2025; trending towards $1T/year.

China AI CapEx: $98B in 2025, with $56B from government.

US Private AI Investment (2024): $109.1B; China: $9.3B.

China domestic AI chip use: Rising from <10% (2024) to 30–40% (2026).

Chip Yield Gap: China 70–80%, TSMC >90%.

Performance Gap: US chips up to 10x better; 30–50% AI efficiency lead.