- Pascal's Chatbot Q&As

- Posts

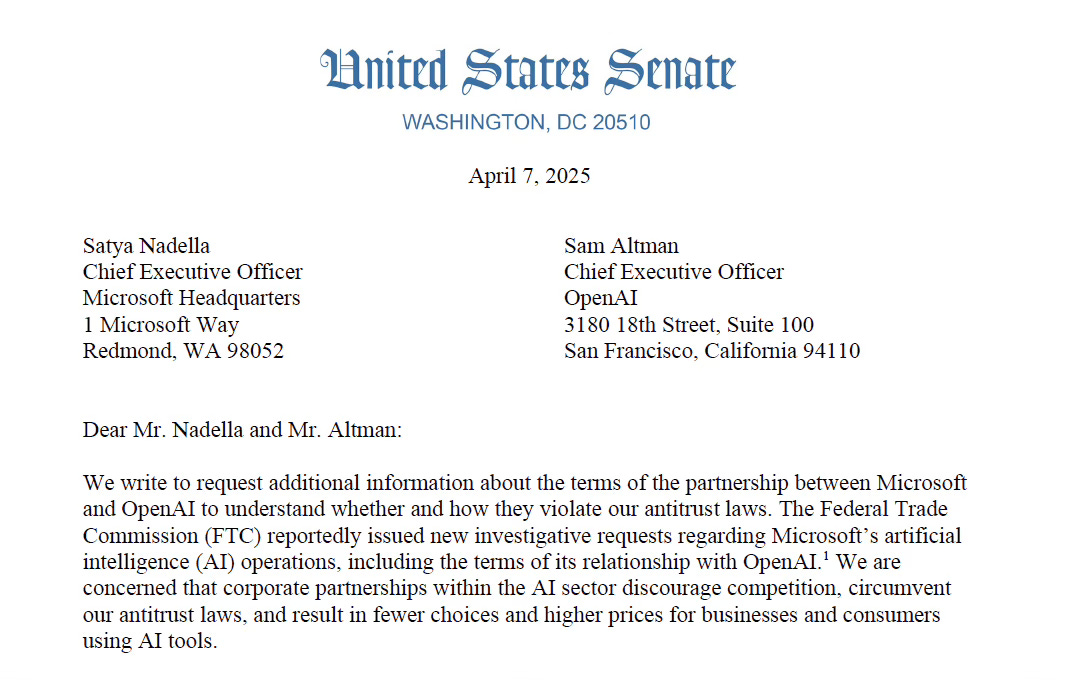

- The senators argue that Google's $3B investment in Anthropic and Microsoft’s deep ties to OpenAI could amount to de facto mergers—without going through merger scrutiny—violating U.S. antitrust laws.

The senators argue that Google's $3B investment in Anthropic and Microsoft’s deep ties to OpenAI could amount to de facto mergers—without going through merger scrutiny—violating U.S. antitrust laws.

EU, UK, and other regulators can adopt similar lines of inquiry—focusing on control, exclusivity, market access, and data-sharing across CSP-AI developer partnerships.

Asking ChatGPT-4o: Please read the articles “Dem. Senators Say Microsoft, Google AI Deals Could Violate Antitrust Laws“ and “Democratic US senators question Google and Microsoft's AI deals“ as well as the associated letters and tell me a) what the key grievances are, b) whether you think any laws might have been breached and c) what the AI makers should do to prevent situations such as these and d) what regulators outside the US should do with this information.

ChatGPT-4o’s answer:

a) Key Grievances by the Senators

Potential Antitrust Violations:

The senators argue that Google's $3B investment in Anthropic and Microsoft’s deep ties to OpenAI could amount to de facto mergers—without going through merger scrutiny—violating U.S. antitrust laws.

Reid Hoffman’s dual board membership on Microsoft and OpenAI is highlighted as a “blatant violation” of antitrust rules.

Market Consolidation:

The partnerships between AI developers and cloud service providers (CSPs) consolidate talent, compute resources, intellectual property, and strategic insight, potentially reducing competition and innovation.

These relationships may make it harder for smaller companies to access essential resources like compute or first-party data.

Preferential Treatment and Lock-In:

Questions are raised about exclusive access to cloud infrastructure, favorable compute pricing, and egress fees that make switching CSPs expensive.

Some contracts reportedly prevent AI developers from launching models outside the CSP ecosystem.

Lack of Transparency and Overlap:

Lawmakers seek clarity on how much influence Microsoft and Google exert over AI startups’ business decisions, talent flows, and strategic planning.

Exclusive Licensing and Revenue Sharing:

Senators are concerned about CSPs having exclusive licensing rights to foundational AI models, limiting market access and choice for others.

b) Have Any Laws Likely Been Breached?

While no final legal determination has been made, there are strong indications of potential antitrust breaches, especially under:

Clayton Act (Section 7) – Partial acquisitions that substantially lessen competition can be challenged, even without full mergers. The partnerships may qualify as “de facto mergers.”

Sherman Act (Section 2) – Behavior that entrenches dominance or restricts new market entrants might be considered monopolistic conduct.

FTC Act (Section 5) – Unfair methods of competition, including leveraging partnerships to gain non-public competitive intelligence, may apply.

Also, interlocking directorates like Reid Hoffman's dual board roles could violate Section 8 of the Clayton Act, which prohibits individuals from serving as officers or directors of competing companies under certain conditions.

That said, actual illegality hinges on facts yet to be disclosed (e.g. control, exclusivity terms, acquisition plans), which is why the senators demand more data.

c) What AI Makers Should Do to Prevent Such Concerns

Increase Transparency:

Disclose the full nature of partnerships, including licensing terms, governance overlaps, and revenue-sharing agreements.

Avoid Exclusive Lock-Ins:

Structure partnerships to allow for multicloud and multi-partner collaboration, avoiding exclusivity clauses that raise switching costs or limit interoperability.

Governance Safeguards:

Avoid shared directors or advisory roles that could lead to conflicts of interest or allegations of collusion.

Fair Access Practices:

Ensure third-party developers can access computing resources and APIs on similar terms to affiliated developers.

Preemptive Antitrust Review:

Conduct internal legal reviews or seek FTC guidance before entering into complex investment/partnership structures.

d) What Non-U.S. Regulators Should Do With This Information

Use the U.S. Letters as a Framework:

EU, UK, and other regulators can adopt similar lines of inquiry—focusing on control, exclusivity, market access, and data-sharing across CSP-AI developer partnerships.

Monitor for De Facto Mergers:

Just like the DOJ and FTC, overseas agencies should scrutinize minority stakes and influence (e.g. Amazon-Anthropic via AWS, Microsoft-OpenAI via Azure) under merger control regimes.

Investigate Cross-Border Market Effects:

Consider whether partnerships are distorting global AI markets—especially in cloud infrastructure, model licensing, or developer access to tools.

Coordinate Enforcement:

Work with U.S. regulators on a multilateral basis to ensure remedies (if needed) are globally effective—e.g. preventing anti-competitive licensing that affects non-U.S. developers.

Protect Local Startups:

Encourage and fund open compute platforms or public AI infrastructure to reduce dependency on Big Tech.