- Pascal's Chatbot Q&As

- Posts

- Gemini: the evidence synthesized in this report points to significant, documented negative consequences stemming from specific Trump administration actions across a wide range of policy areas...

Gemini: the evidence synthesized in this report points to significant, documented negative consequences stemming from specific Trump administration actions across a wide range of policy areas...

...affecting the American public. Policies exacerbated economic inequality, with benefits flowing to corporations and high-income individuals, while costs fell heavily on lower-income groups.

An Analysis of Documented Negative Impacts of Trump Administration Policies on the American Public

by Gemini Advanced, Deep Research with 2.5 Pro.

I. Introduction

Purpose: This report analyzes specific actions undertaken by the Trump administration since taking office and their documented negative impacts on the American public, drawing exclusively from the provided research material. The analysis focuses on corroborating evidence of adverse effects across key policy domains, including the economy, healthcare, the environment, immigration, social policy, and trade as it affects the United States.

Methodology: The analysis employs a thematic approach, examining policy actions such as legislative changes, executive orders, and administrative decisions. It synthesizes the impacts documented in research reports, studies, and expert analyses found within the provided sources. Where available, public opinion data reflecting sentiment towards these policies and the administration is incorporated. The report concludes with a predictive analysis based on these synthesized findings.

Scope: The scope is defined by the timeframe beginning when the administration took office and focuses specifically on the direct negative consequences for the American public as documented within the supplied research materials. While policy impacts are often complex and subject to debate, this report adheres to the specific request to detail documented negative outcomes identified in the sources.

Roadmap: The report proceeds by examining economic policy impacts, including fiscal policy and trade actions. It then analyzes consequences within the healthcare system, focusing on the Affordable Care Act and Medicaid. Subsequently, it addresses environmental deregulation and climate policy changes. The analysis continues with repercussions of immigration policy shifts and impacts related to social policy and civil rights. Finally, it synthesizes public opinion data and expert commentary before offering a predictive analysis of potential public reaction to continued similar policy directions.

II. Economic Policy Impacts

The economic policies of the first Trump administration included significant tax cuts, trade protectionism, deregulation, and responses to the COVID-19 pandemic.1 While proponents often claimed these policies would foster broad prosperity, analyses indicate several negative consequences for the federal budget, income inequality, economic performance, and specific sectors like agriculture.

A. Fiscal Policy: Tax Cuts, Deficits, and Debt

Action: The cornerstone of the administration's fiscal policy was the Tax Cuts and Jobs Act (TCJA) of 2017.1 This legislation enacted substantial changes, most notably a permanent reduction in the corporate income tax rate from 35% to 21%.2 It also included numerous temporary changes to the individual income tax code, set to expire at the end of 2025, such as lower marginal rates, a near-doubling of the standard deduction, the elimination of personal and dependent exemptions, an expansion of the child tax credit (with new refundability limits and SSN requirements), and a $10,000 cap on the deduction for state and local taxes (SALT).4 Other significant provisions included temporary expensing for equipment investment, elimination of the corporate alternative minimum tax, an increase in the estate tax exemption, and a new 20% deduction for certain pass-through business income.3 The elimination of the Affordable Care Act's individual mandate penalty was also included as a permanent provision within the TCJA.6

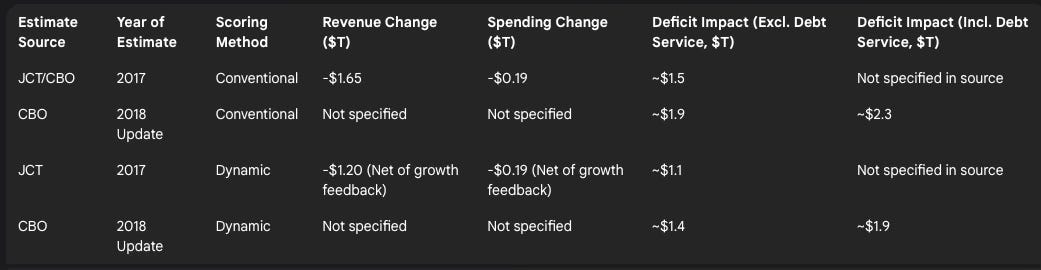

Negative Impact (Deficit/Debt): Contrary to initial Republican discussions about revenue-neutral tax reform 4 , the TCJA led to substantial reductions in federal revenue and significant increases in projected federal deficits and debt. Official estimates from the Joint Committee on Taxation (JCT) and the Congressional Budget Office (CBO) consistently showed the law adding between $1 trillion and $2 trillion to the national debt over its first decade (2018-2027), even when accounting for potential economic growth effects (dynamic scoring).4 The JCT's conventional estimate projected a revenue reduction of $1.65 trillion over ten years.4 CBO's updated conventional estimate placed the deficit increase closer to $1.9 trillion over the same period, rising to nearly $2.3 trillion when including the associated debt service costs.4 Dynamic scoring, which attempts to incorporate macroeconomic feedback, still projected deficit increases of $1.1 trillion (JCT) to $1.4 trillion (CBO update), or $1.9 trillion including debt service (CBO update).4 These projections represented a marked deterioration of the fiscal outlook; the CBO forecast in April 2018 indicated that cumulative deficits over the 2018–2027 period would be $4.3 trillion (46%) higher than the baseline projected just before the TCJA's passage.1 This trajectory contributed to a 39% increase in the U.S. national debt during the Trump term, reaching $27.75 trillion, and pushed the debt-to-GDP ratio to a post-World War II high.1 The Government Accountability Office (GAO) warned that the federal government's fiscal path was unsustainable, projecting the debt-to-GDP ratio would surpass its historical high within 15 to 25 years under prevailing policies. The GAO highlighted negative long-term consequences of such debt levels, including reduced national savings and income, increased government interest costs pressuring other budget priorities, limited capacity for lawmakers to respond to unforeseen events like pandemics or recessions, and an increased likelihood of a fiscal crisis.9 The structure of the TCJA, with individual tax cuts expiring in 2025 while corporate cuts were permanent 2 —a design influenced by Senate budget rules 4 —created a future fiscal pressure point. Extending these expiring provisions, a politically likely scenario, would add trillions more to the debt ($3.4 trillion to $4 trillion+ over ten years, according to JCT and TPC estimates) 5 , further exacerbating the long-term fiscal imbalance. This structure essentially deferred the full cost, masking a future choice between large debt increases or allowing taxes to rise, potentially disproportionately affecting middle-income households if extensions are not funded.3 The decision to prioritize large, unfunded tax cuts significantly constrained the government's fiscal space, impacting its ability to fund public investments or respond effectively to subsequent crises like the COVID-19 pandemic, which necessitated large relief packages like the CARES Act against an already weakened fiscal backdrop.1

Negative Impact (Inequality): Analyses consistently found that the benefits of the TCJA were heavily skewed towards corporations and high-income households, thereby worsening income inequality.1 The Tax Policy Center estimated that in 2025, households in the top 1% would receive an average tax cut exceeding $60,000, compared to less than $500 for households in the bottom 60%.2 As a share of after-tax income, the benefits for the top 1% and top 5% were more than triple the value received by the bottom 60%.13 The corporate tax cuts, the law's most expensive provision, disproportionately benefited wealthier households who own the majority of corporate stock.2 This distributional outcome led critics to label the law a "reverse Robin Hood" policy.12

Negative Impact (Revenue Erosion): The substantial revenue loss resulting from the TCJA 4 eroded the country's capacity to fund critical programs and make necessary public investments.1 This occurred at a time when demographic shifts, particularly the aging of the baby boomer generation, are increasing the costs of Social Security and Medicare, and rising healthcare costs and emerging needs like climate change demand greater resources.11 Budget proposals during the Trump presidency reflected attempts to offset costs through cuts to programs serving low- and moderate-income individuals, such as SNAP, Medicaid, and housing assistance, though many proposed cuts did not pass Congress.12

Table 1: Estimated 10-Year Deficit Impact of the Tax Cuts and Jobs Act (TCJA)

Note: Figures are approximate based on cited sources.[4] Spending changes primarily reflect reduced healthcare spending linked to ACA changes. Estimates vary based on baseline assumptions and specific features analyzed.

B. Economic Performance: Investment, Wages, and Jobs

Action: Proponents of the TCJA asserted it would invigorate the economy by stimulating business investment, leading to higher wages and accelerated job growth.2

Negative Impact (Investment): Despite claims, evidence indicates the TCJA had little positive impact on business investment.1 Some analyses suggest the rate of overall business investment actually slowed in the two years following the law's enactment compared to the two years prior.7 A Tax Policy Center review concluded the TCJA had minimal effect on business investment.1 Specific provisions, like the 20% pass-through deduction intended to boost small business investment, showed no significant effect on investment, wages, or employment, potentially encouraging tax avoidance instead.7 Furthermore, CBO analysis projected that extending the temporary TCJA provisions would ultimately reduce private investment in the long run due to the "crowding out" effect of higher government borrowing and interest rates.5 Research published by the National Bureau of Economic Research (NBER) indicated the TCJA's effects were complex and uneven across firms, creating both winners and losers, and that market participants struggled to anticipate the actual impacts even as the law was being passed.15

Negative Impact (Wages): The administration's predictions of substantial wage gains for average households (claims of $4,000 to $9,000 annually) failed to materialize.2 Data comparisons showed that real wage growth actually slowed during the Trump administration compared to the rate at the end of the Obama administration.1 A significant study by economists affiliated with the JCT and the Federal Reserve Board, matching corporate tax data with worker earnings, found "no change in earnings" attributable to the corporate rate cut for workers in the bottom 90% of their firm's income distribution (those earning below roughly $114,000 in 2016).2 While earnings increased for the top 10%, particularly managers and executives, the broad-based wage growth promised did not occur.2 Aggregate economic studies generally did not find a significant short-term impact of the TCJA on labor compensation.7 This suggests the central mechanism claimed by proponents—that corporate tax cuts would directly translate into higher wages for typical workers—did not function as predicted. Corporations appeared to use the tax savings for other purposes, such as stock buybacks or executive pay, rather than broad investment and wage increases for the majority of their workforce.

Negative Impact (Jobs/Growth): The pace of job creation also slowed compared to the period preceding the administration.1 Overall economic growth (real GDP) showed little change in the two years after the TCJA relative to the two years before.7 One analysis attributed a slight rise in GDP growth during this period more to bipartisan increases in government spending (following the 2018 Bipartisan Budget Act) than to the tax cuts themselves.7 While the COVID-19 pandemic significantly impacted the labor market later in the term, the pre-pandemic economic data did not reflect the surge promised by TCJA proponents.1 The administration left office with approximately 3 million fewer jobs than when it began, making Trump the only modern president to oversee a net job loss, albeit heavily influenced by the pandemic.1 Importantly, long-term CBO projections indicated that extending the TCJA would actually shrink the economy due to the negative effects of rising deficits and interest rates.5

C. Trade Policy: Tariffs and Retaliation

Action: The administration pursued an aggressive protectionist trade policy, imposing tariffs on a wide range of imports. This began in January 2018 with tariffs on solar panels and washing machines.16 In March 2018, tariffs of 25% on steel and 10% on aluminum were imposed on imports from most countries, covering a significant portion of US imports.16 These were extended to key allies like the European Union, Canada, and Mexico in June 2018.16 Separately, escalating tariffs were levied on hundreds of billions of dollars worth of goods imported from China, triggering a trade war.16 Further tariff actions occurred in 2025, including additional duties on imports from China, Mexico, and Canada (though exemptions and pauses were later applied, particularly for USMCA-compliant goods), and broad "reciprocal" tariffs intended to match the rates other countries impose on US exports.18 By 2025, estimates suggested over 70% of US imports faced new tariffs.19

Negative Impact (Consumer Costs): A fundamental misunderstanding propagated by the administration was that exporting countries pay the tariffs; economic consensus and numerous studies confirm that tariffs are taxes paid by American importers, which are largely passed on to American consumers and businesses in the form of higher prices.16 Research showed the initial washing machine tariffs raised prices by approximately 12%.17 Tariffs on Chinese goods led to price increases of 10-30% for US intermediate goods.17 The Consumer Price Index (CPI) for tariffed products rose sharply compared to other goods.17 The comprehensive 2025 tariffs were projected by the Yale Budget Lab to increase the overall US price level by 2.9% in the short run, translating to an average loss of purchasing power of $4,700 per household (in 2024 dollars), settling at a 1.7% increase ($2,700 loss per household) after consumers adjusted purchasing patterns.18 The Tax Foundation estimated the 2025 tariffs represented an average tax increase of $1,243 per household 19 , constituting one of the largest tax increases in decades.16 Specific sectors faced dramatic price hikes: apparel prices were projected to rise 64% short-term, motor vehicle prices 19% long-term (adding roughly $9,000 to the cost of an average new car), and food prices 3% long-term.18 These price increases disproportionately harm lower- and middle-income households, making tariffs a regressive form of taxation.18 Public opinion reflected these concerns, with majorities disapproving of the tariff increases 24 and polls indicating a belief that the administration was focusing too much on tariffs relative to inflation.25

Negative Impact (US Economy - GDP, Jobs): Studies concluded that the tariffs reduced real income in the United States and adversely affected GDP.16 The Yale Budget Lab estimated that the 2025 tariffs, including expected foreign retaliation, would reduce US real GDP growth by 1.1 percentage points, increase the unemployment rate by 0.6 percentage points, and result in 740,000 fewer jobs in 2025. The long-term impact was projected to be a persistently 0.6% smaller US economy, equivalent to an annual loss of $170 billion.18 The Tax Foundation estimated the tariffs would reduce long-run GDP by 0.8% (1.0% including retaliation) and cost the equivalent of 671,000 full-time jobs (before accounting for retaliation).19 Imports were projected to decline substantially, by nearly $800 billion or 23% in 2025.19 Expert economists from institutions like the Peterson Institute for International Economics (PIIE) widely condemned the tariffs' economic rationale, predicting slower growth, higher inflation, increased unemployment, and heightened recession risk.23 Bank of America projected the tariffs would add over $3,000 to the cost of an average US-assembled vehicle.22 The strategy appeared rooted in a flawed understanding of trade economics, particularly regarding bilateral trade balances and who bears the cost of tariffs, leading to self-inflicted economic harm. The focus on bilateral deficits ignored the principle of comparative advantage and the fact that the overall US trade deficit is driven by macroeconomic factors like national saving and investment, not just tariffs.23

Negative Impact (US Agriculture): The agricultural sector was particularly hard-hit by retaliatory tariffs imposed by countries like China, Canada, Mexico, and the EU in response to US actions.21 A USDA Economic Research Service (ERS) study estimated that from mid-2018 to the end of 2019, retaliatory tariffs caused U.S. agricultural export losses exceeding $27 billion ($13.2 billion annualized).28 Soybeans accounted for the largest share of these losses (nearly 71%), followed by sorghum and pork.28 Major agricultural states in the Midwest, such as Iowa, Illinois, and Kansas, suffered the most significant losses.28 China, a critical market for US farmers, implemented tariffs that drastically reduced US market share initially, although some recovery occurred following the Phase One trade agreement.21 The 2025 tariff escalations prompted renewed retaliation targeting US agriculture.21 Beyond lost export markets, farmers also faced increased costs for essential imported inputs like fertilizer (especially potash from Canada) and farm equipment due to US tariffs.29 Major farm organizations, including the American Farm Bureau Federation (AFBF), National Farmers Union (NFU), and International Fresh Produce Association (IFPA), voiced strong concerns, warning that tariffs threatened farm profitability, increased input costs, could lead to long-term market share losses, and potentially force farm closures.30 This situation created an internal policy contradiction: the administration's tariffs harmed farmers, necessitating billions of dollars ($28 billion over 2018-2020) in taxpayer-funded aid through the USDA's Commodity Credit Corporation (CCC) to mitigate the damage, effectively subsidizing the negative consequences of its own trade policy.21

Negative Impact (International Relations/Strategy): The administration's unilateral imposition of tariffs, often justified by national security claims (Section 232 for steel/aluminum) or trade imbalances, disregarded established international trade rules under the World Trade Organization (WTO) and strained relationships with key allies and trading partners.16 The "reciprocal tariff" concept was widely criticized by economists as based on a misunderstanding of trade economics.23 This approach fostered global economic uncertainty, damaged US credibility as a reliable partner, and was perceived by some as bullying rather than constructive negotiation.22

III. Healthcare System Consequences

The Trump administration pursued policies that significantly impacted the U.S. healthcare system, primarily through efforts to repeal or undermine the Affordable Care Act (ACA) and alter Medicaid financing and eligibility. These actions generated considerable concern regarding coverage stability, affordability, and access to care, particularly for vulnerable populations and those in rural areas.

Continue reading here (due to post length constraints): https://p4sc4l.substack.com/p/gemini-the-evidence-synthesized-in