- Pascal's Chatbot Q&As

- Posts

- By embedding restrictive, anti-progressive provisions in general appropriations language, Trump is restructuring governance — shrinking public capacity while enhancing executive control.

By embedding restrictive, anti-progressive provisions in general appropriations language, Trump is restructuring governance — shrinking public capacity while enhancing executive control.

While cloaked in efficiency rhetoric, the underlying result may be a brittle, hollowed-out federal infrastructure incapable of responding to emerging challenges and less accountable to the public.

The Trump Administration’s FY 2026 Budget Proposal — Austerity, Centralization, and Controversy

by ChatGPT-4o

The three documents — the OMB Appendix FY2026 Budget, the GSA FY2026 Congressional Justification, and the White House TMF Proposal — collectively articulate a dramatic repositioning of federal priorities under the Trump administration’s 2026 fiscal plan. They center on government-wide austerity, reorganization, and privatization-like efficiencies.

Key Highlights:

General Budget Architecture (OMB Appendix):

Imposes strict general provisions across all federal agencies, notably:

Repeals or restricts DEI (Diversity, Equity, Inclusion) training programs (Sec. 712).

Bans use of funds for prepackaged federal news stories lacking attribution (Sec. 725).

Restricts use of funds for agency contracts tied to election-related political donations (Sec. 728).

Limits support for federal employee unions and imposes loyalty-type provisions around U.S. citizenship for employment (Sec. 704).

GSA’s Role in "Efficiency":

Proposes aggressive real estate consolidation through the sale of underutilized assets.

Plans a 30% workforce reduction from FY2025 levels.

Cuts reliance on external consultants and centralizes IT procurement and infrastructure into "shared services."

Reduces operational budgets below FY2019 levels (adjusted for inflation), citing deficit reduction goals.

Emphasizes terminating leases and rationalizing the federal footprint with legislative support from the Thomas R. Carper Water Resources Development Act of 2024.

Technology Modernization Fund (TMF):

No new discretionary appropriations for TMF in FY2026.

Instead, GSA is empowered to repurpose unobligated expired discretionary funds from other agencies — a move framed as resourceful, but which lacks clear congressional appropriations oversight.

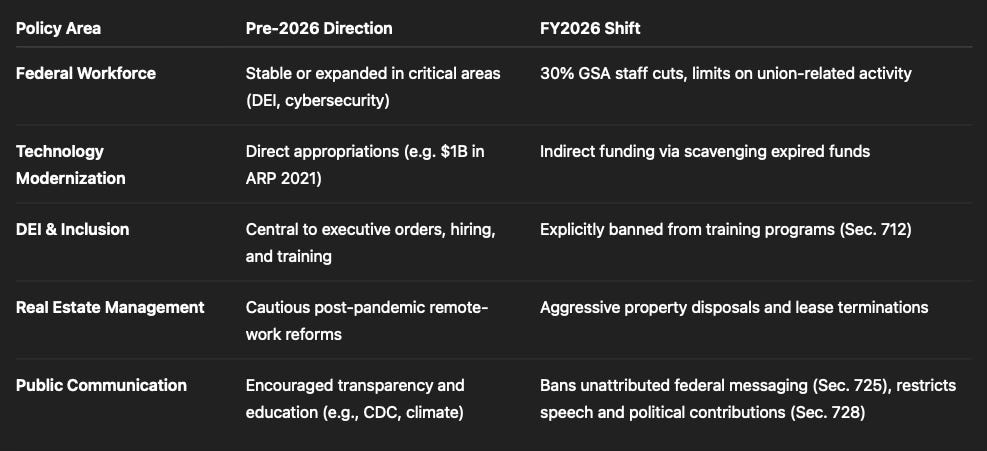

Differences from Previous U.S. Government Policy

The Trump administration’s FY2026 budget departs significantly from previous bipartisan traditions, especially the Biden-era investment in modernization, climate adaptation, DEI programs, and expansive tech infrastructure:

These shifts indicate a deliberate ideological rejection of prior progressive governance frameworks, reframing government as bloated and misaligned with conservative values.

Downsides and Critical Risks

While framed as “efficient,” the FY2026 proposals raise several profound concerns:

1. Demoralization and Attrition of Public Sector Talent

The 30% workforce cut at GSA alone risks a major decline in institutional knowledge, innovation, and operational continuity — all during a time of rising demand for digital public services and crisis response infrastructure.

2. Erosion of DEI and Scientific Integrity

The categorical restriction of DEI training could deter top candidates from underrepresented backgrounds and halt decades of incremental progress in federal inclusivity.

Provisions that limit speech and policy transparency (Sec. 725 and 728) could hinder the ability of agencies to communicate effectively or respond to misinformation.

3. Budgetary Sleight of Hand

The TMF's new funding model depends on the discretionary “rescue” of expired funds — a process lacking congressional granularity and vulnerable to political manipulation or misalignment with pressing digital needs.

4. Privatization-by-Stealth

The forced consolidation and sale of government real estate assets, while framed as rational, echoes historic patterns of public asset liquidation that benefit private interests — raising questions about who profits from “efficiency.”

5. Accountability Weakening

Reducing Inspector General oversight budgets (keeping them flat amid inflation) and centralizing policy enforcement under GSA with expanded authority, diminishes institutional checks and balances.

6. Politicization of Procurement and Employment

Restrictions tied to political donations or citizenship language in hiring provisions may violate constitutional principles and risk politicizing procurement and HR processes.

Why the Trump Administration May Be Taking This Path

The Trump administration’s 2026 strategy aligns with several familiar motives:

Ideological Alignment: The rejection of DEI, union rights, environmental regulation, and federal oversight aligns with long-standing conservative grievances about the “administrative state.”

Budget Optics: The appearance of fiscal restraint — despite expanding defense budgets elsewhere — is a classic maneuver to appeal to deficit hawks and libertarian factions.

Preemptive Damage Control: Following controversies in 2025 (not detailed in the documents, but alluded to by public discourse and partisan media), this plan serves as both distraction and deflection, redirecting public anger toward “bloated bureaucracy.”

Power Centralization: Shifting control toward the Executive (e.g., GSA collecting funds without explicit appropriations) reduces congressional power and increases White House flexibility to act without legislative roadblocks.

Conclusion: Strategic Retreat or Authoritarian Efficiency?

This FY2026 budget is less a financial document than a blueprint for ideological transformation. By embedding restrictive, anti-progressive provisions in general appropriations language, the Trump administration is restructuring governance — shrinking public capacity while enhancing executive control.

While cloaked in efficiency rhetoric, the underlying result may be a brittle, hollowed-out federal infrastructure incapable of responding to emerging challenges — from climate crises to cybersecurity threats — and less accountable to the public.

Recommendations:

Congress should reassert appropriations oversight and reject provisions that bypass democratic checks (e.g., TMF reallocation scheme).

Agencies should assess the legal and constitutional risks of implementing workforce and DEI restrictions.

Civil society and the press must scrutinize asset sales, contracting changes, and hiring practices for signs of cronyism or discrimination.

Regulators should investigate whether anti-DEI or speech-limiting provisions violate civil rights or employment law.

The future of American public service — its values, its talent, its trust — is very much at stake in this budget.