- Pascal's Chatbot Q&As

- Posts

- Analysis of Trump's policies: Evidence suggests a convergence of factors where a deliberate project of targeted societal restructuring and a system of pervasive self-enrichment are the primary drivers

Analysis of Trump's policies: Evidence suggests a convergence of factors where a deliberate project of targeted societal restructuring and a system of pervasive self-enrichment are the primary drivers

This potent combination, in turn, creates the dangerous social and economic preconditions that align with historical patterns of manufacturing consent for war.

An Analysis of Competing Explanations for the Policies of the Trump Administration

by Gemini 2.5 Pro, Deep Research. Warning! LLMs may hallucinate!

Introduction

This report provides a comprehensive analysis of the motivations and consequences of the Trump administration's policy agenda by critically evaluating four distinct, yet interconnected, hypotheses. The administration's actions, characterized by their departure from established norms and their significant societal impact, have prompted a range of explanations from observers and analysts. This report seeks to discern the validity of these competing frameworks by systematically examining a wide corpus of evidence, including economic data, policy documents, legal records, investigative journalism, and political theory.

The four primary hypotheses under consideration are:

Systemic Corruption and Self-Enrichment: This theory posits that a primary driver of the administration's policies is the personal and political financial enrichment of the president, his family, and a close circle of allies and donors. Under this framework, state power is leveraged to secure private financial gain, and policy decisions are fundamentally transactional.

Ideologically-Driven Mismanagement: This argument suggests that the negative economic and social outcomes are the consequence of a chaotic, unpredictable, and non-traditional approach to policymaking. Rooted in a populist, anti-establishment ideology, this approach disregards conventional expertise and institutional processes, leading to policy incoherence, administrative decay, and economic instability as byproducts rather than as primary goals.

Targeted Societal Restructuring: This hypothesis contends that the administration is engaged in a deliberate project to re-engineer American society along specific demographic and ideological lines. Policies are intentionally designed to disadvantage and harm specific groups—particularly non-white, migrant, and LGBTQ+ communities—while simultaneously advancing the interests and values of a white, Christian nationalist constituency.

Geopolitical Strategy of War Preparation: This is a more speculative theory which proposes that the intentional creation of domestic hardship, the destruction of knowledge and prosperity, and the fostering of social unrest are strategic tools. The aim is to manufacture a state of societal discontent that makes the populace more receptive to a future foreign conflict, which can then be justified by scapegoating an external adversary.

This report will proceed by examining each of these arguments in separate sections, marshaling the relevant evidence for each. It will then synthesize these findings, exploring the significant interplay and overlap between the motivations. Finally, it will provide a ranked assessment of the four hypotheses based on the weight, quality, and directness of the available evidence, concluding with a summary of the findings and identifying avenues for further inquiry. The analysis aims to provide a nuanced and rigorously supported understanding of the complex forces shaping contemporary American governance.

Section I: The Argument from Economic Mismanagement and Ideological Disruption

This section assesses the proposition that the Trump administration's actions and their resulting economic consequences are best understood not as a coherent, malicious plan, but as the product of an unconventional, ideologically-driven, and often chaotic approach to governance. From this perspective, the negative economic outcomes—such as rising debt, increased inflation, and sector-specific stagnation—are the foreseeable results of incompetence, policy incoherence, and a fundamental disregard for established economic principles and institutions. The disruption is thus seen as a consequence of a particular governance style rather than a means to a hidden end.

Fiscal and Tax Policy - A Foundation of Instability

The fiscal policy of the Trump administration has been a primary source of economic instability, characterized by a deep and persistent contradiction between its tax and spending priorities. During its first term, the administration's signature legislative achievement was the 2017 Tax Cuts and Jobs Act (TCJA). This law enacted a steep reduction in the corporate tax rate from 35% to 21% and provided broad, though unequally distributed, individual income tax cuts.1 These tax reductions were not accompanied by corresponding spending cuts; instead, they were coupled with significant increases in federal spending. This combination had a predictable and dramatic effect on the nation's finances, causing the federal budget deficit to increase by nearly 50% to almost $1 trillion by 2019 and contributing to a 39% rise in the total national debt over the course of the term.3

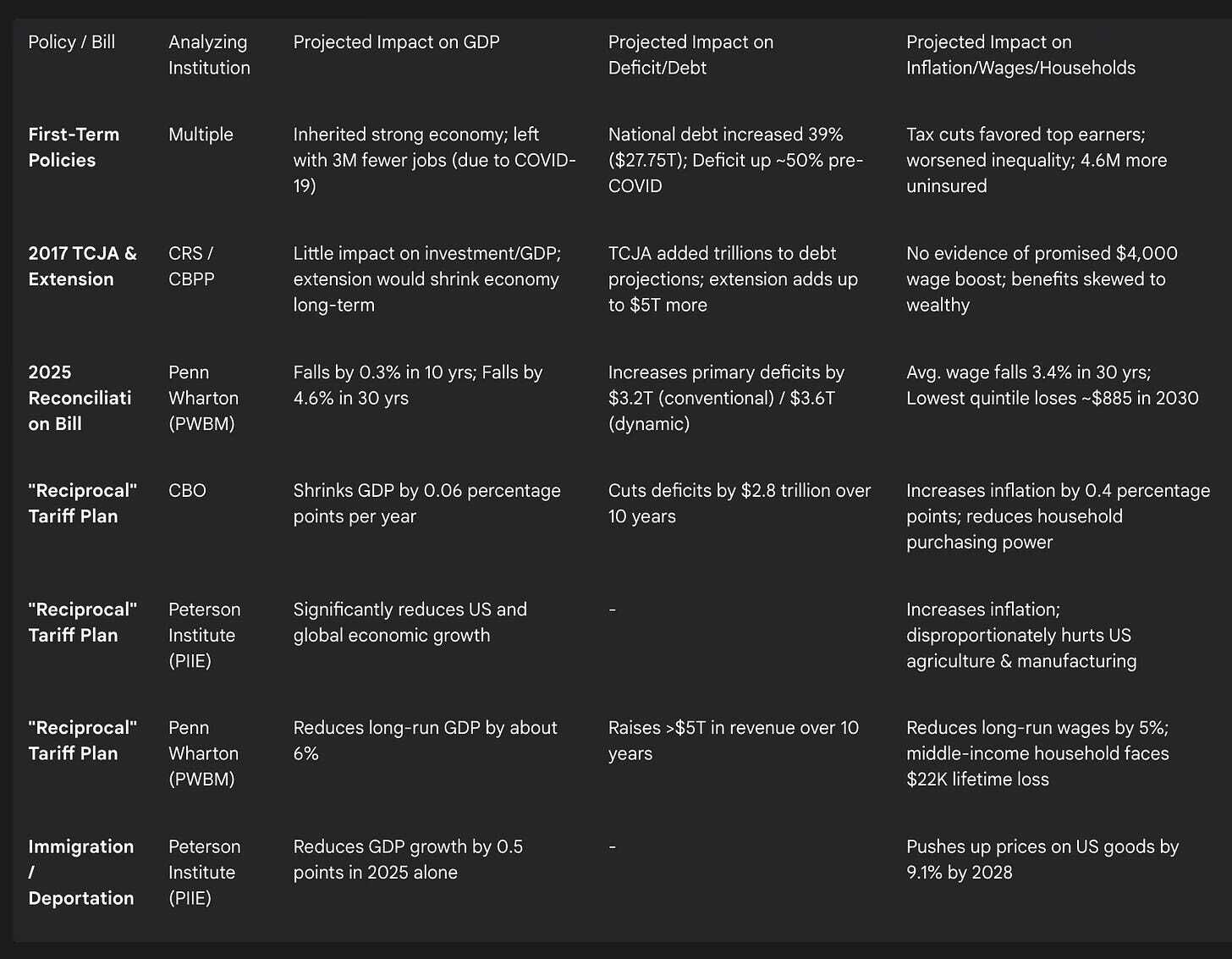

This fiscal trajectory has been extended and amplified in the administration's second term. The legislative agenda, centered on a reconciliation package often referred to as the "One Big Beautiful Bill," seeks to make the TCJA's provisions permanent and expand upon them.4 Independent economic modeling provides a stark forecast of the consequences. The Penn Wharton Budget Model (PWBM) projects that the bill will increase primary deficits by $3.2 trillion on a conventional basis and $3.6 trillion when accounting for dynamic economic effects over the next decade.4

Crucially, economic analyses from a range of institutions indicate that the foundational promises of the TCJA were not realized. Studies by the non-partisan Congressional Research Service (CRS) and the center-left Center on Budget and Policy Priorities (CBPP) found no evidence of the law having significant positive impacts on business investment, GDP growth, or wages during the pre-pandemic period.2 These analyses suggest that extending the law would, in the long run, actually shrink the economy, primarily because the rising deficits and debt would lead to higher interest rates and "crowd out" private investment.2 The PWBM's dynamic analysis of the 2025 reconciliation bill reinforces this conclusion, projecting a long-term decrease in GDP of 4.6% and a fall in average wages of 3.4% after 30 years, driven by a phenomenon known as capital shallowing, where the amount of capital per worker decreases.4

A closer examination of the administration's fiscal posture reveals a strategy built on a fundamental contradiction, seemingly designed to serve competing political objectives at the expense of coherent economic policy. The administration operates on two parallel but conflicting fiscal tracks. The first track involves the pursuit of massive, unfunded tax cuts, exemplified by the TCJA and its proposed extension. These policies, which are projected by non-partisan bodies like the PWBM and the Congressional Budget Office (CBO) to add trillions to the national debt, appeal directly to the traditional Republican and corporate donor base that favors a low-tax, deregulated environment.1 This is a clearly stated ideological priority.

Simultaneously, the administration operates on a second track, implementing a radical and aggressive tariff regime. In a key finding that the White House has used to justify its tax policies, the CBO projected that these tariffs would reduce federal deficits by $2.8 trillion over a decade.7 This allows the administration to publicly claim that its protectionist measures will offset the fiscal impact of its tax cuts.7 The result is a deeply incoherent policy mix. The tax cuts are designed to be stimulative (at least in theory) but are demonstrably deficit-increasing. The tariffs, conversely, are economically contractionary—projected to shrink GDP and household purchasing power—but are deficit-reducing.7 This is not simply random mismanagement; it appears to be a deliberate political strategy to cater to two distinct constituencies. The tax cuts satisfy the financial and corporate elite, while the tariffs and the associated "foreigners will pay" rhetoric appeal to the populist, nationalist base. The economic incoherence and profound uncertainty that result from this two-track approach are not just side effects; they become a primary drag on the economy, supporting the argument that the administration's approach is defined by politically motivated mismanagement rather than sound economic stewardship.9

Trade and Tariff Regimes - Protectionism and Unpredictability

The administration's approach to international trade represents a radical departure from decades of U.S. policy, embracing an aggressive and unilateral protectionism. This policy has been implemented through a sweeping series of tariffs targeting major trading partners, including China, the European Union, and Mexico, as well as more than 20 other nations, with duty rates ranging from a baseline of 10% to as high as 50% on specific goods.3 The stated rationale for this "America First" trade policy is to reduce bilateral trade deficits, which the President has equated with economic loss, and to protect and revitalize the domestic manufacturing sector.13

The implementation of this policy has been widely described as chaotic and unpredictable. Major tariff announcements, delays, and revisions have often been communicated via social media platforms with little warning, creating an environment of "massive tariff uncertainty" for businesses attempting to manage global supply chains and make long-term investment decisions.10 This volatility has been a consistent theme, with the administration imposing, pausing, and then escalating tariffs, leaving manufacturers and international partners in a state of limbo.9

Economists and policy analysts from across the political spectrum have concluded that the fundamental premise of this trade policy is flawed and that its consequences are overwhelmingly negative for the U.S. economy. Analysts at the right-leaning American Enterprise Institute (AEI) have pointed out a basic economic error in the administration's logic, noting that a nation's overall trade deficit is a macroeconomic function of its national savings and investment rates, not the level of its tariffs.17 Independent analyses from institutions like the Peterson Institute for International Economics (PIIE), the CBO, and the PWBM corroborate this view, projecting that the tariffs will reduce both U.S. and global economic growth, increase domestic inflation, and shrink the real purchasing power of American households by thousands of dollars per year as the costs are passed on to consumers.1

Despite the stated goal of boosting American manufacturing, the evidence suggests the policy has had the opposite effect. The sector has shown persistent signs of stagnation and, in some periods, job losses since the tariffs were implemented. This is because many U.S. manufacturers rely on imported raw materials and intermediate goods. Tariffs on inputs like steel and aluminum raise production costs for domestic companies, making their final products more expensive and less competitive both at home and abroad.15 As one Massachusetts-based industrial tool maker noted, his company continues to source steel from Europe and pay the tariffs because of quality and price dynamics that domestic suppliers cannot match.15 The policy uncertainty has further compounded these issues, leading businesses to postpone or cancel investment and hiring plans.9

The administration's trade policy appears to be fundamentally self-defeating, as the chosen tool (tariffs) actively works against the stated goals of strengthening the economy and bringing back manufacturing jobs. This dynamic reveals a form of mismanagement that is rooted not just in chaotic execution but in a flawed understanding of modern economics. The policy prioritizes a simplistic and politically resonant narrative—punishing foreign competitors—over the complex realities of integrated global supply chains.

The process begins with the stated goal to protect U.S. industry.14 The method chosen is the imposition of steep, broad-based tariffs on imported goods, including critical industrial inputs.15 The immediate effect is that U.S. producers who depend on these inputs see their costs rise, eroding their profit margins and competitiveness.15 This is compounded by the broader effect of extreme policy volatility, which freezes investment and purchasing decisions throughout the economy.9 The final outcome is not a manufacturing renaissance but stagnation, job losses, and higher prices for consumers.7 This suggests that the policy's failure is not an unforeseen accident but a predictable result of its design. The mismanagement lies in the elevation of a populist narrative over economic reality, with predictably negative consequences for the very industries and workers the policy purports to help.17

The Economics of Administrative Chaos and Institutional Decay

Beyond the direct impact of specific fiscal and trade policies, a significant argument for mismanagement stems from the administration's systematic degradation of institutional capacity, predictability, and the rule of law. This form of mismanagement is not about individual policy errors but about the erosion of the stable framework required for a modern economy to function. The administration has pursued a broad "downsizing" of government, most notably through the creation of the Department of Government Efficiency (DOGE), an initiative that has led to mass layoffs, abrupt workforce reductions, and the targeted dismantling of core functions at key agencies, including the Department of Education, the Environmental Protection Agency (EPA), and the U.S. Agency for International Development (USAID).1

This administrative upheaval has been accompanied by sustained attacks on the independence of other critical economic institutions. The President has publicly assailed the Federal Reserve and its Chair, whom he labeled a "numbskull" and accused of "monetary malpractice" for not cutting interest rates on demand, thereby undermining the central bank's credibility and political independence.23 Furthermore, the administration has been accused by the Government Accountability Office (GAO) of unconstitutional impoundment—illegally refusing to spend funds appropriated by Congress for specific programs, thereby usurping Congress's power of the purse.24

Analysts at the Economic Policy Institute (EPI) have described these actions as an "illegal attack on the public sector" that creates "unprecedented levels of economic uncertainty" and is "tailor-made to freeze business investment".22 The chaotic and unpredictable nature of this governance style is a recurring theme in economic critiques. Policy reversals occur within days, often announced on social media, and the courts are flooded with litigation challenging the administration's measures.9

This pattern of institutional decay may represent the most profound economic drag imposed by the administration. Modern market economies are built on a foundation of stable institutions, predictable rules, and confidence in the rule of law. When this foundation is deliberately shaken, it introduces a level of systemic risk that can chill investment and long-term growth far more than any single tax or tariff policy. The administration's actions—dismantling federal agencies, attacking the central bank, ignoring congressional appropriations, and governing in a reactive and unpredictable manner—inject this systemic risk directly into the economy.9

This creates multiple low-probability but high-impact "tail risks." For example, the EPI notes the danger that the DOGE initiative, given its demonstrated misunderstanding of complex government systems, could inadvertently cause a delay or default on federal payments, such as interest on U.S. Treasury bonds—an event that would trigger a global financial crisis.22 The international think tank Chatham House identifies the primary economic risk of the administration not as any specific policy, but as a broader "loss of confidence in US governance".26 This loss of confidence is reflected in financial markets; the Peterson Institute for International Economics (PIIE) has observed that market reactions to the administration's policies, such as a falling dollar and rising bond yields, suggest that global investors are demanding a higher risk premium to hold U.S. assets.8

In this context, the "mismanagement" argument gains its greatest force. The chaos appears to be more than just a leadership style; it is a fundamental economic variable. The degradation of the civil service, the Federal Reserve, and the appropriations process attacks the core infrastructure of the U.S. economy. This is a form of mismanagement that erodes the foundations of American economic strength, making the country poorer and more fragile regardless of the administration's stated intentions.9

Table 1: Comparative Analysis of Macroeconomic Projections

Section II: The Argument from Targeted Societal Restructuring

This section evaluates the substantial body of evidence suggesting that the Trump administration's policies are not merely the result of mismanagement or a generic ideology, but constitute a deliberate, systematic, and coherent effort to re-engineer American society. This framework posits that many policies are intentionally designed to harm or disadvantage specific demographic groups—particularly non-white, immigrant, and LGBTQ+ communities—while simultaneously advancing the social, cultural, and economic interests of a white, Christian nationalist constituency. From this perspective, the economic consequences, while significant, are often secondary to the primary objective of social and demographic transformation.

Dismantling the Public Sphere and Social Safety Net

A core component of the administration's agenda has been a broad assault on public institutions and the social safety net, with actions that appear designed to enforce ideological conformity and punish perceived political adversaries. This has been most evident in the fields of education and healthcare.

In education, the administration has launched a sweeping campaign to dismantle Diversity, Equity, and Inclusion (DEI) initiatives at every level. Through a series of executive orders, it has ended affirmative action programs for federal contractors (EO 14151), terminated federal grants containing DEI or critical race theory content, and reinterpreted civil rights law to invalidate all DEI programs at educational institutions.20 This ideological crusade has been backed by punitive financial measures. The administration has frozen billions of dollars in federal grants and contracts to prominent universities—including Harvard, Columbia, and Cornell—citing concerns over their DEI policies and alleged antisemitism.20 This has been coupled with a dramatic hollowing out of the federal apparatus for education, with the Department of Education (USED) experiencing a workforce reduction of nearly half its staff, crippling its civil rights, special education, and research functions.20

A similar approach has been taken in healthcare and social welfare. Proposed budgets from the administration have called for draconian cuts to the social safety net, including a projected $920 billion reduction to Medicaid and a $451 billion cut to Medicare over a ten-year period.30 During its first term, the administration's persistent efforts to repeal or sabotage the Affordable Care Act (ACA), without a viable replacement, led to an increase of 4.6 million in the number of uninsured Americans.3 The administration has also targeted student loan borrowers, abruptly ending an interest-free payment pause for nearly 8 million people. This single administrative action is projected by the Student Borrower Protection Center to cost the typical affected borrower more than $3,500 in additional interest charges per year, imposing a new financial burden of over $27 billion annually on these households.31

These actions reveal a clear pattern of using the full administrative power of the executive branch—including funding freezes, grant revocations, politically motivated legal reinterpretations, and mass layoffs—as a tool for ideological enforcement. The targets are consistently institutions and programs associated with liberal or progressive values: universities, public schools, DEI offices, and foundational social safety net programs like Medicaid.20 The justifications provided are explicitly ideological, such as ending "radical indoctrination" or "gender ideology extremism".20 Federal funding is explicitly used as a lever to compel compliance with these ideological mandates.20 This represents a significant shift from traditional policy debate to the weaponization of the administrative state against political and cultural opponents. The goal appears to be not merely fiscal conservatism but the active dismantling of the institutional pillars that support a pluralistic and secular society, lending strong credence to the argument of a targeted societal restructuring.

Differential Impacts on Racial, Ethnic, and Migrant Communities

The administration's policies have consistently produced disproportionately negative outcomes for non-white, ethnic, and migrant communities, suggesting a coordinated strategy to re-entrench racial and social hierarchies. This pattern is evident across immigration, federal employment, tax policy, environmental regulation, and the honoring of obligations to Indigenous peoples.

The administration's hardline immigration policies are a central pillar of this agenda. These policies include proposals for large-scale deportation efforts, the imposition of stricter work visa requirements, and sharp reductions in legal immigration quotas.1 Economic analysis by the PWBM projects that mass deportations would significantly harm the U.S. economy by reducing the labor force and, critically, by cutting Social Security tax revenues, thereby accelerating the depletion of the program's trust fund.33 These policies have a particularly acute impact on Black migrants from African and Caribbean nations, who are often overlooked in the broader immigration debate but face unique vulnerabilities.34

Within the domestic sphere, the administration's actions threaten key sources of economic stability and mobility for Black and Brown communities. The rollback of DEI programs and the attack on civil service protections are particularly damaging, as federal government employment has historically served as a crucial pathway to the middle class for Black families, who are overrepresented in the federal workforce.35 The administration's tax policies have exacerbated these trends. Analyses of the 2017 TCJA show that its benefits flowed overwhelmingly to the wealthiest households, which are predominantly white, thereby widening the existing racial wealth gap.5 A fact-check of claims about wage gains found that while inflation-adjusted earnings for Black workers did rise slightly during Trump's first term, the wage gap between white and Black workers actually widened.39

The administration has also systematically dismantled environmental justice protections. It has revoked key executive orders, eliminated the EPA's Office of Environmental Justice, and removed public access to data tools like EJScreen, which are essential for identifying and mitigating the disproportionate burden of pollution borne by communities of color and low-income areas.40 This leaves these communities more vulnerable to the health impacts of industrial pollution.42

Furthermore, the administration's policies have had a devastating impact on Native American communities. A sweeping federal grant freeze has been found to jeopardize over $24.5 billion in funding designated for Tribal governments and Native organizations. This action not only risks the collapse of essential services in health, education, and infrastructure but also represents a direct violation of the U.S. government's long-standing trust and treaty obligations to sovereign Tribal nations.43 Analysis of grant cancellations has revealed that programs with the word "Tribal" in their name have been disproportionately targeted, suggesting a deliberate defunding of Indigenous communities.43

When viewed collectively, these policies do not appear to be isolated or coincidental. They form a coherent, multi-pronged strategy that systematically attacks the economic, legal, and physical security of non-white communities. The administration's rhetoric of creating a "color-blind" society 35 functions as an ideological justification for dismantling the very programs and protections designed to address systemic inequality. This coordinated assault across multiple policy domains provides powerful evidence for the argument that the administration is engaged in a deliberate project of targeted societal restructuring aimed at reasserting a racial hierarchy.

A third pillar of the societal restructuring argument is the administration's aggressive promotion of a socially conservative and Christian nationalist worldview, primarily through policies targeting LGBTQ+ rights and reproductive freedom. This agenda appears to employ a sophisticated political strategy of "divide and conquer" to achieve its goals.

The administration has engaged in what critics and advocacy groups have described as an "unprecedented assault" on the LGBTQ+ community, with a particular and strategic focus on transgender individuals.44 The policies are extensive and implemented through executive orders, agency rule-making, and budget cuts. They include a ban on transgender people serving in the military; the rescission of non-discrimination protections in healthcare, housing, and education; and the formal definition of "sex" in federal policy as an immutable, binary biological classification assigned at birth, effectively erasing the legal recognition of transgender identity.30 The administration has also cut federal funding for programs that support LGBTQ+ people, including public health initiatives for HIV/AIDS prevention.44 Furthermore, broader policies, such as cuts to Medicaid and the imposition of work requirements, are projected to disproportionately harm LGBTQ+ individuals, who rely on the program for health coverage at higher rates due to greater experiences with poverty and disability.48

Continue reading here (due to post length constraints): https://p4sc4l.substack.com/p/analysis-of-trumps-policies-evidence