- Pascal's Chatbot Q&As

- Posts

- AI is moving beyond backend analysis and decision support towards direct involvement in operational tasks, including autonomous navigation, targeting, and even combat maneuvers.

AI is moving beyond backend analysis and decision support towards direct involvement in operational tasks, including autonomous navigation, targeting, and even combat maneuvers.

AI plays an increasingly integral role in sensing, deciding, and acting on the battlefield, potentially at speeds exceeding human capacity. This raises critical questions.

The Algorithmic Battlefield: How Technology Companies are Shaping Modern Warfare

by Gemini Advanced, Deep Research with 2.5 Pro. Warning, LLMs may hallucinate!

1. Executive Summary

The landscape of modern warfare is undergoing a profound transformation, driven significantly by the accelerating integration of advanced technologies traditionally developed in the commercial sector. This report analyzes the deepening relationship between well-known technology companies—ranging from established giants like Google (Alphabet), Microsoft, and Amazon (AWS) to rapidly scaling defense-focused startups such as Palantir Technologies, Anduril Industries, Shield AI, and Applied Intuition—and the military-industrial complex, particularly the U.S. Department of Defense (DoD). Findings indicate a paradigm shift where software, artificial intelligence (AI), autonomous systems, and cloud computing are becoming central to military capabilities. Major defense contracts, exemplified by the multi-billion dollar Joint Warfighting Cloud Capability (JWCC) and the AI-focused Project Maven, underscore the DoD's reliance on commercial innovation. Concurrently, the rise of specialized defense tech firms, often backed by significant venture capital, challenges traditional procurement models and introduces new dynamics. This convergence, however, is fraught with ethical debates surrounding AI in warfare, surveillance, and data privacy, often sparking internal dissent within tech companies and public controversy. The development and deployment of these technologies, particularly evident in conflicts like the war in Ukraine, are reshaping military doctrine, force structures, and the very nature of global security competition. This report details the specific contributions of key companies, analyzes critical technology domains, examines the procurement environment, and considers the future trajectory of technology in warfare.

2. The Convergence of Silicon Valley and the Military-Industrial Complex

Setting the Stage: A New Era of Defense Technology

For decades, defense innovation was largely the domain of established prime contractors—companies like Boeing, Lockheed Martin, Northrop Grumman, Raytheon (now RTX), and General Dynamics, whose names became synonymous with military hardware.1 However, the 21st century has witnessed a significant strategic shift. The U.S. Department of Defense (DoD) and its associated intelligence agencies are increasingly turning to the commercial technology sector, including Silicon Valley giants and agile startups, to harness cutting-edge advancements, particularly in software, artificial intelligence (AI), cloud computing, and data analytics.3 This trend represents a departure from the traditional model, driven by the recognition that critical innovations relevant to national security are often emerging from commercial enterprises.3

While this convergence appears novel, it echoes, in part, the early history of Silicon Valley, which was significantly fueled by military research and development funding, a connection sometimes overlooked in the contemporary tech narrative.5 The current dynamic, however, is distinct due to the nature of the technologies involved. The emphasis is less on bespoke military hardware and more on adapting powerful software, AI algorithms, and vast data processing capabilities—often dual-use in nature—for defense applications.4 This marks a qualitative shift, moving towards what some describe as "war by algorithms".4

Drivers of Convergence

Several powerful forces are driving this intensified collaboration between the technology sector and the defense establishment:

Technological Advancements: The unprecedented pace of innovation in areas like AI, machine learning (ML), autonomous systems, cloud computing, big data analytics, and sensor fusion offers capabilities that promise to revolutionize military operations.3 AI, in particular, is seen as enabling faster decision-making, automating complex tasks like target recognition, and making sense of the deluge of data from modern sensors.4

Geopolitical Imperatives: Heightened strategic competition with nations like China and Russia, which are actively developing and integrating similar advanced technologies into their military forces, creates a powerful impetus for the U.S. and its allies to maintain a technological advantage.4 Ongoing conflicts, such as the war in Ukraine, serve as real-world proving grounds, demonstrating the battlefield impact of commercially derived technologies like drones, AI-powered targeting systems, and sophisticated ISR (Intelligence, Surveillance, and Reconnaissance) capabilities.3 This creates a feedback loop, further accelerating demand for these technologies.

DoD Modernization Efforts: The Pentagon has launched ambitious initiatives specifically designed to leverage commercial technology. Joint All-Domain Command and Control (JADC2) aims to connect sensors, platforms, and personnel across all warfighting domains, heavily relying on advanced networking, data fusion, and AI.13 Project Maven focuses explicitly on operationalizing AI for ISR data analysis.5 The transition from the canceled JEDI contract to the multi-cloud JWCC program highlights the strategic importance of commercial cloud infrastructure.27 Furthermore, the DoD established organizations like the Defense Innovation Unit (DIU, formerly DIUx) specifically to streamline engagement with non-traditional tech companies and accelerate the adoption of commercial solutions.1

Economic Incentives: The defense market offers significant financial opportunities for technology companies. Unlike often volatile consumer markets, defense contracts can provide stable, long-term revenue streams, often with high margins.1 For startups, securing DoD contracts can be transformative, validating their technology and providing substantial funding for growth, attracting significant venture capital investment.3

These drivers are deeply interconnected. The pressure of geopolitical competition fuels DoD modernization efforts, which in turn creates demand for specific advanced technologies readily available in the commercial sector. This demand generates lucrative economic opportunities, pulling tech firms—both established players and new entrants—deeper into the defense ecosystem, creating a cycle of increasing interdependence.

The New Ecosystem: Startups and Giants

The contemporary defense technology landscape is characterized by a diverse ecosystem involving both established technology corporations and a new breed of defense-focused startups:

Established Tech Giants: Companies like Google (Alphabet), Microsoft, and Amazon (AWS) leverage their vast resources, global cloud infrastructure, extensive AI research capabilities, and existing enterprise relationships to compete for and win large-scale defense contracts, particularly those focused on foundational capabilities like cloud computing (JWCC) or large-scale AI initiatives.8

Defense Tech Startups: A significant cohort of venture capital-backed startups has emerged, explicitly targeting the defense market. Companies like Palantir Technologies, Anduril Industries, Shield AI, and Applied Intuition often adopt a "software-first" approach, emphasizing AI, autonomy, and data analytics.2 They frequently position themselves as more agile, innovative, and responsive to warfighter needs than the traditional, larger defense primes, aiming to disrupt the established industrial base.3

Partnerships and Collaboration: The ecosystem is not solely defined by competition. Strategic partnerships are common, including collaborations between startups and traditional prime contractors to access larger programs of record 1 , and alliances between tech companies themselves to combine complementary capabilities (e.g., Anduril and Microsoft partnering on the IVAS program 37 , Anduril and OpenAI collaborating on AI solutions 11 , Palantir forming partnerships with other AI firms 24 ).

This evolving landscape suggests a bifurcation in the market. Large tech companies are solidifying their roles as providers of essential, scalable infrastructure (like cloud services), while specialized firms (startups and specific divisions within larger companies) focus on developing and integrating cutting-edge applications, particularly in AI and autonomy. This dynamic fosters both intense competition for contracts and necessary collaboration to deliver complex, integrated systems.

3. Profiles in Defense Technology: Leading Tech Companies and Their Warfare Contributions

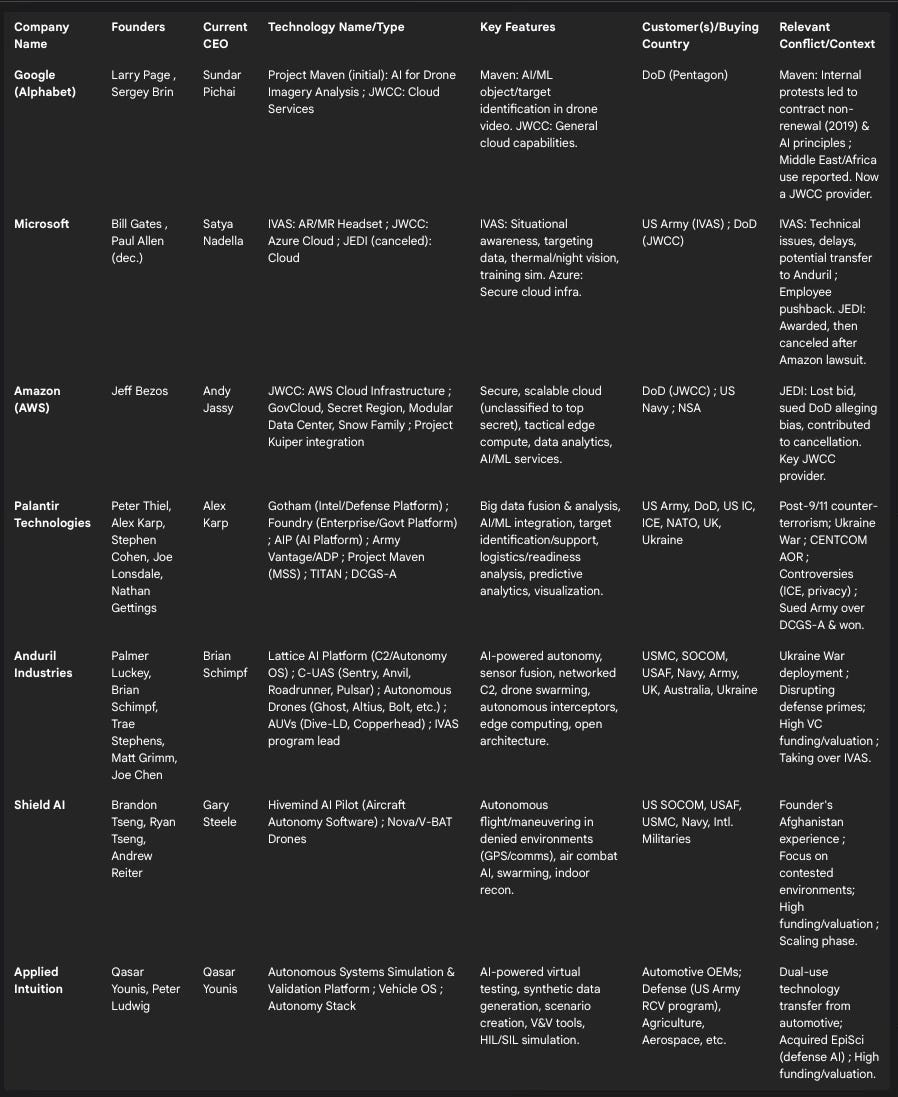

This section provides detailed profiles of prominent technology companies significantly involved in developing technologies for military and warfare applications. It outlines their leadership, the specific technologies created, key features, primary customers, and the relevant geopolitical or controversial contexts surrounding their involvement.

Summary Table: Tech Companies and Warfare Technologies

Google (Alphabet)

Leadership: Founded in 1998 by Stanford PhD students Larry Page and Sergey Brin, Google, now under the parent company Alphabet Inc., is led by CEO Sundar Pichai, who holds the CEO position for both Google and Alphabet.49 Page and Brin remain influential shareholders but stepped back from daily operations in 2019.49

Technology and Features: Google's most prominent and controversial involvement in military technology was its participation in the DoD's Project Maven.8 This project aimed to use AI and machine learning to accelerate the analysis of vast amounts of full-motion video footage captured by military drones, automatically identifying objects, vehicles, and potentially targets.9 The goal was to improve the efficiency of intelligence analysis and potentially enhance the precision of drone operations.8 Google executives described their specific contribution as relatively limited, primarily involving the application of existing, open-source AI algorithms.21 Beyond Maven, Google Cloud is now positioned to provide general cloud computing services to the DoD as one of the awardees of the multi-billion dollar JWCC contract.31

Continue reading here (due to post length constraints): https://p4sc4l.substack.com/p/ai-is-moving-beyond-backend-analysis