- Pascal's Chatbot Q&As

- Posts

- A powerful cohort of Silicon Valley executives, in close alliance with the Trump administration, is systematically re-engineering the U.S. national security apparatus to serve a dual agenda of...

A powerful cohort of Silicon Valley executives, in close alliance with the Trump administration, is systematically re-engineering the U.S. national security apparatus to serve a dual agenda of...

...ideological techno-supremacy and commercial profit. They are building an apparatus that is structurally predisposed to technological and military solutions, that profits directly from instability.

The New Arsenal of Democracy: Silicon Valley, the Trump Administration, and the Monetization of Conflict

by Gemini 2.5 Pro, Deep Research. Warning! LLMs may hallucinate!

Introduction: From Code to Camo

The period since 2024 has witnessed an unprecedented acceleration in the convergence of Silicon Valley and the U.S. military, moving beyond a traditional contractor relationship to a deep, symbiotic integration of personnel, ideology, and capital. This fusion, particularly under the Trump administration, represents a fundamental restructuring of the American military-industrial complex. It is a paradigm shift marked by tech executives donning military uniforms, defense policy being shaped by venture capitalists, and the very nature of warfare being reimagined through the lens of software and artificial intelligence. This report will analyze whether this convergence is a pragmatic response to new geopolitical realities or a deliberately engineered paradigm that profits from and perpetuates a state of conflict.

At the heart of this transformation are a handful of key actors and entities whose strategies and influence are reshaping national security. The corporations at the forefront include Palantir Technologies, the data-mining behemoth; Anduril Industries, the disruptive defense-tech startup; and legacy giants like Microsoft, Meta, and OpenAI, which are increasingly aligning their capabilities with military objectives. These companies are led and financed by a tight-knit group of influential individuals, with Peter Thiel—co-founder of Palantir and a powerful political operator—serving as the ideological and financial linchpin. His protégés and allies, such as Palantir CEO Alex Karp and Anduril founder Palmer Luckey, act as the public evangelists for this new techno-militarist movement.

Their integration into the state apparatus is being formalized through a series of government initiatives. The Army’s Detachment 201 program directly commissions tech executives as senior officers.1 The Defense Innovation Unit (DIU) and Defense Innovation Board (DIB) create dedicated channels for Silicon Valley to influence Pentagon policy and procurement.2 Meanwhile, vast, technologically ambitious projects like the AI-driven Project Maven and the proposed "Golden Dome" missile defense system create a near-insatiable demand for their specific products and expertise.4

This deep integration raises a critical question. Are these tech titans simply answering a patriotic call to bolster national defense in the face of new threats? Or are they actively architecting a future where their products—and their influence—are indispensable? A future that, to be fully realized, may require heightened global tensions or even the perpetual risk of war. The evidence suggests a complex interplay of motives, where ideological conviction, commercial ambition, and political power have merged to create a system that monetizes instability and positions a new class of tech oligarchs as the arbiters of 21st-century conflict.1

I. The New Praetorian Guard: Silicon Valley in Uniform

The most visible and perhaps most significant manifestation of the new military-tech complex is the formal integration of Silicon Valley executives into the U.S. military's command structure. This is not a matter of arms-length consultation but of embedding private sector leaders within the institution they seek to supply and influence. This section details the mechanisms of this integration, which signal a profound shift from an external vendor relationship to one of internal command influence.

Detachment 201: The Executive Innovation Corps

In a move that starkly illustrates this new paradigm, the U.S. Army established "Detachment 201: The Executive Innovation Corps" in June 2025.1 This program directly commissions senior tech executives into the Army Reserve at the unusually high rank of lieutenant colonel, a position that typically takes a career officer nearly two decades to achieve.1 The inaugural class of these instant officers includes Shyam Sankar, Chief Technology Officer of Palantir; Andrew "Boz" Bosworth, CTO of Meta; Kevin Weil, Chief Product Officer of OpenAI; and Bob McGrew, an advisor at Thinking Machines Lab and former research head at OpenAI.1

The stated purpose of the program is to "fuse cutting-edge tech expertise with military innovation" and provide high-level advice on the Army's modernization efforts.1 However, the strategic significance extends far beyond mere technical advice. By bestowing military rank, the program grants these executives a level of internal access, legitimacy, and influence that no civilian contractor or consultant could ever command. As one of the participants, Kevin Weil, argued, advice is "more seriously heeded" when it comes from an individual "wearing the same uniform, having taken the same oath".1 This blurs the line between a vendor selling a product and a uniformed leader shaping military requirements from within the system.

The special treatment afforded to these executives underscores their elite status. They are not required to complete the Army's full six-week Direct Commissioning Course or pass the standard Army Fitness Test, and they are permitted to fulfill some of their 120 annual service hours remotely—privileges not extended to other reservists.1 This has drawn criticism that the program allows "rich tech bros cosplaying" as soldiers and creates a two-tiered system within the Reserve.1 The optics are secondary to the function: to create a high-status, low-friction pathway for the tech elite to embed themselves within the military hierarchy. This arrangement creates a powerful feedback loop. An executive whose company is a leading contender for military AI contracts can now advise the Army on how to structure its AI requirements, creating an undeniable conflict of interest.4 More broadly, the program serves as a powerful piece of propaganda, rebranding military service for a new generation of tech talent as a prestigious, high-status endeavor, thereby ensuring a future pipeline of engineers willing to build military technology.8

Beyond the Reserves: The Pentagon's Silicon Valley Outposts

The direct commissioning of executives is complemented by institutional structures designed to bridge the gap between the Pentagon and the tech industry. These "outposts" serve as conduits for technology, capital, and ideology to flow from Silicon Valley into the heart of the Defense Department.

The Defense Innovation Unit (DIU), established in 2015, is a DoD organization headquartered in Silicon Valley with the explicit mission to accelerate the military's adoption of commercial technology.2 Initially an experiment, the DIU's influence has surged under the Trump administration. In 2023, Defense Secretary Lloyd Austin elevated the organization to report directly to his office, and for fiscal year 2024, Congress boosted its budget to $983 million.11 The DIU now acts as a "sherpa" for non-traditional defense companies, helping them navigate the Pentagon's notoriously complex bureaucracy and creating a dedicated pipeline for firms like Anduril to secure contracts.11

Advising the Pentagon at the highest level is the Defense Innovation Board (DIB), a panel of private sector experts that provides recommendations directly to the Secretary of Defense on emerging technologies.3 Chaired by billionaire Michael Bloomberg, the DIB's membership includes prominent figures from the tech and venture capital worlds. The board has been a key advocate for expanding the DIU's role and budget, reinforcing the systemic push to integrate the fast-paced, disruptive model of Silicon Valley into the Pentagon's core acquisition and development processes.11

Despite their expanding influence and budgets, these innovation hubs have faced substantive criticism regarding their effectiveness. A 2025 report from the U.S. Government Accountability Office (GAO) found that the DIU has a "limited ability to gauge progress" because it lacks a complete performance management process. The GAO noted that the DIU has not set measurable goals or metrics to assess its progress, raising fundamental questions about its accountability and its true impact on fielding capabilities at scale.13 This lack of oversight suggests that while these units are effective at channeling funds and fostering relationships, their contribution to actual military readiness remains difficult to quantify.

The establishment of these formal channels—from direct commissions to dedicated innovation hubs—represents more than just a desire for expert advice. It signifies the creation of a new, privileged class within the national security apparatus. These mechanisms grant tech executives insider status and the power to shape military needs from within, effectively normalizing the tech-military officer as a permanent fixture. This cultural and structural shift ensures that the worldview and commercial interests of Silicon Valley are no longer external pressures on the Pentagon but are integrated into its very DNA.

II. The Techno-Industrial Offensive: Corporate Strategy and Market Capture

The deep integration of personnel is mirrored by an aggressive corporate strategy aimed at capturing a dominant share of the burgeoning military technology market. This market, projected to grow from $3.5 billion in 2024 to $10.4 billion by 2032, is increasingly defined by AI and autonomous systems.15 The leading firms in this space—Palantir, Anduril, and legacy giants like Microsoft—have developed business models and technologies designed to thrive in an environment of heightened military spending and intense technological competition. Their strategies reveal a clear intent not just to supply the military, but to fundamentally reshape the business of war.

Palantir: The All-Seeing Eye of the State

Palantir Technologies, co-founded by Peter Thiel, has positioned itself as the central nervous system of the modern security state. Its business model revolves around embedding its powerful data analytics platforms—Palantir Gotham for defense and intelligence clients and Palantir Foundry for commercial and civil government sectors—into the core operations of its customers.16 Through high-value, long-term contracts, Palantir's software becomes indispensable for sifting through vast, disparate datasets to find patterns, generate intelligence, and support decision-making, including targeting.17

This strategy has proven immensely lucrative. The company's revenue reached $2.86 billion in 2024, with a market valuation of $41 billion.17 Its stock has surged, driven by a steady stream of massive government contracts that constitute the majority of its earnings.19 Palantir's CEO, Alex Karp, has openly stated that "bad times are very good for Palantir because we build products... that are built for danger".1

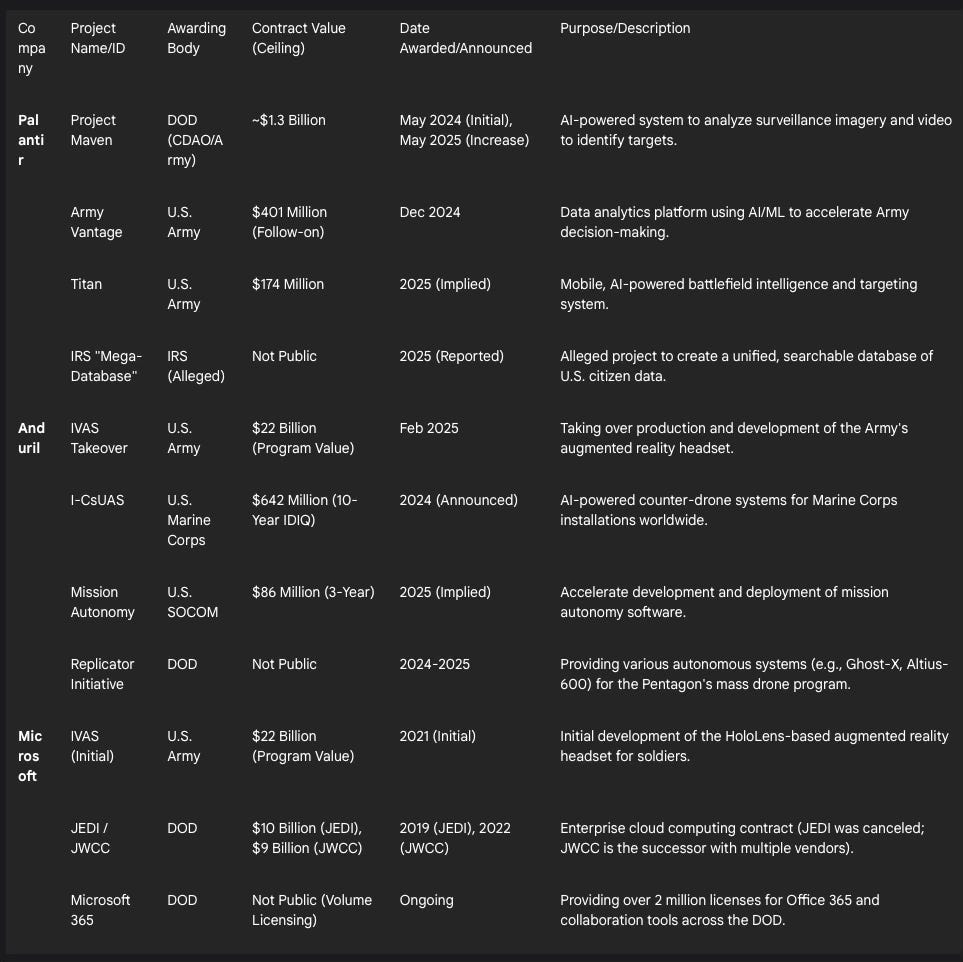

Palantir's key military and government projects underscore its deep integration with U.S. national security and its controversial role in surveillance and warfare:

Project Maven: After Google withdrew in 2018 amid employee protests, Palantir eagerly stepped in to take over this critical Pentagon AI program, which uses machine learning to analyze drone footage and identify potential targets.7 Citing "growing demand," the DoD recently raised the contract ceiling for Palantir's work on Maven to nearly $1.3 billion.4 The project has been used in live-fire exercises and active conflicts in Ukraine, Iraq, Syria, and Yemen.21

Army Vantage: Palantir holds a $401 million follow-on contract to support the Army's primary data analytics platform, which leverages AI and machine learning to accelerate decision-making on everything from personnel readiness to logistics.23

Tactical Intelligence Targeting Access Node (Titan): The company secured a $174 million contract to develop this mobile, AI-powered battlefield intelligence system, designed to provide targeting data to forces at the tactical edge.7

IRS "Mega-Database": In one of its most controversial engagements, Palantir is reportedly helping the Trump administration build a unified, searchable database of American citizens' information for the IRS. This has sparked alarm among lawmakers and civil liberties groups, who fear it could be used for mass surveillance and the targeting of political opponents.24

Anduril: Disrupting the Business of War

Anduril Industries, founded by Palmer Luckey, represents a radical departure from the traditional defense contracting model. Instead of waiting for the Pentagon to issue a request and then developing a product on a cost-plus government contract, Anduril uses its own venture capital funding for research and development. It proactively builds advanced autonomous systems and then sells them to the government as finished products at a fixed price, betting that the military will recognize their value.28 Anduril's executive chairman, Trae Stephens, has described this as a "Trojan Horse" strategy: the company wraps its core product—the Lattice AI software operating system—in hardware ("metal") because it is "significantly easier for the customer to buy metal than it is to buy the software".30

This disruptive model has fueled explosive growth. Anduril's revenue was estimated to have hit $1 billion in 2024, a 138% year-over-year increase, with a valuation soaring to $14 billion.31 The company boasts "SaaS-like" gross margins of 40-45%, a stark contrast to the 8-10% typical for legacy defense contractors, by avoiding the margin caps of cost-plus contracts.31

Anduril's portfolio of projects demonstrates its focus on an AI-driven, autonomous future for warfare:

Global Contract Volume: The company is on track to surpass $6 billion in worldwide government contracts by the end of 2025.28

IVAS Takeover: In a significant move, Anduril has partnered with Microsoft to take over the troubled $22 billion Integrated Visual Augmentation System (IVAS) program. Anduril will now oversee production and future development of the augmented reality headsets for the Army, a project Microsoft struggled to execute.32

Autonomous Weapons Suite: Anduril is developing a family of AI-powered systems, including the Fury unmanned fighter jet, the Roadrunner reusable drone interceptor, and the Dive-LD large autonomous submarine, all controlled by its Lattice OS.28

Counter-Drone Systems: The company secured a 10-year, $642 million contract to provide its AI-powered counter-unmanned aerial systems (CUAS) to protect U.S. Marine Corps installations globally.36

Microsoft: The Legacy Giant's Uneasy Alliance

As a legacy tech giant, Microsoft navigates a more complex position. It continues to pursue and win massive defense contracts while simultaneously facing significant internal dissent from employees who object to their work being used for military applications. Open letters from employees protesting the IVAS contract declared, "We did not sign up to develop weapons," and argued that the technology would turn warfare into a "simulated 'video game'".37

Despite this internal pressure, Microsoft's leadership has consistently reaffirmed its commitment to the DoD.40 Its major defense-related projects highlight both its immense scale and its struggles:

IVAS: The initial $22 billion contract to adapt its HoloLens for military use was plagued by development issues and negative feedback from soldiers, ultimately leading Microsoft to hand over control of the program to Anduril. This move signals Microsoft's difficulties in managing large-scale military hardware development and its strategic shift toward providing the underlying cloud and AI infrastructure while letting partners handle the hardware.32

JEDI Cloud Contract: Microsoft's win of the $10 billion Joint Enterprise Defense Infrastructure (JEDI) cloud contract was mired in controversy. Amazon Web Services filed a lawsuit alleging "improper pressure" and political interference from President Trump, who had a well-documented animosity toward Amazon's founder, Jeff Bezos.42 The case underscored the deep politicization of major defense procurement under the Trump administration.

Enterprise Software: The DoD remains one of Microsoft's largest customers, maintaining over 2 million Microsoft 365 licenses across the department, representing a massive and continuous revenue stream, though this is now under review for potential cuts to rein in spending.45

The distinct strategies of these companies reveal a crucial point: their business models are, in effect, a form of policy advocacy. The traditional, slow, and bureaucratic defense acquisition process is an obstacle to firms like Anduril, whose model is predicated on speed and proactive innovation. For Palantir, its value is maximized when organizations are drowning in data and feel an urgent need for centralized sense-making. Therefore, for these companies to achieve their full market potential, the Pentagon's entire culture of procurement and its strategic posture must align with their vision of warfare—a vision that is software-centric, AI-driven, and in a constant state of rapid evolution. Their intense lobbying and cultivation of political allies are not merely aimed at winning the next contract but at rewriting the rules of the entire game. They are actively influencing policy to create a market that only they, and companies built in their image, are designed to dominate.

III. Architects of Influence: The Political Machinery of the Tech Elite

The successful capture of the military technology market is not merely a function of superior products; it is the result of a sophisticated and deeply integrated political influence operation. This operation extends from the highest levels of the executive branch down to the specific government offices that write and award contracts. By mapping these networks of power, it becomes clear how financial contributions, personal relationships, and ideological alignment are being systematically translated into favorable policy and lucrative, often sole-source, contracts.

The Thiel Nexus: Kingmaker of the Techno-Nationalist Right

At the center of this political machinery is Peter Thiel, the billionaire co-founder of Palantir, an early investor in Anduril, and a pivotal figure in the modern conservative movement. Thiel's influence is not just financial; it is deeply ideological and personal. He was one of Donald Trump's earliest and most prominent Silicon Valley supporters during the 2016 campaign and has remained a key power broker.47 His influence was reportedly instrumental in Trump's selection of J.D. Vance as his Vice President, a politician Thiel has mentored and financially supported for years.47

Thiel's power is exercised through a network of allies and former employees placed in key positions throughout the Trump administration. This network allows him to shape policy from the inside. Trae Stephens, a partner at Thiel's venture fund, Founders Fund, and co-founder of Anduril, has reportedly been considered for Deputy Secretary of Defense.47 Kevin Harrington, another Thiel acolyte, was named Deputy Assistant to the President for strategic planning, a role that allows him to influence the long-term priorities of the National Security Council.49 This strategic placement of personnel ensures that Thiel's worldview—a unique blend of libertarianism, nationalism, and authoritarianism that advocates for "escaping politics" and allowing tech titans to remake the world free from democratic constraints—is not just an external lobbying position but an internal guiding philosophy for the administration.47

Lobbying, Foundations, and the Revolving Door

The personal influence of figures like Thiel is amplified by a more traditional, yet highly effective, corporate influence apparatus. Palantir's lobbying expenditures have skyrocketed, growing from just over $1 million in 2016 to more than $5.7 million in 2024.51 The company has retained Trump-connected lobbying firms like Miller Strategies to ensure its voice is heard in the halls of power.48

Beyond direct lobbying, Palantir has adopted the playbook of other corporate giants by creating its own policy-shaping institutions. In 2023, it quietly launched the "Palantir Foundation for Defense Policy and International Affairs," a non-profit organization designed to sponsor academic research, fellowships, and conferences on national security issues.51 This allows Palantir to create an intellectual and policy echo chamber, funding research and commentary that validates its worldview and promotes policy ideas that serve its business interests.

The most critical component of this influence machine is the "revolving door" between the tech industry and the government agencies that regulate and contract with it. An investigation by the Tech Transparency Project found a particularly robust revolving door between Palantir and the Pentagon's Chief Digital and Artificial Intelligence Office (CDAO), the very unit that oversees the military's adoption of AI and data analytics.48 This creates a situation where former Palantir employees can shape the requirements for contracts that their former employer is uniquely positioned to win. The nomination of Michael Obadal, a senior director at Anduril, to be the Army Undersecretary is a stark example. In this role, he would oversee the Army's budget and weapon investment decisions, creating a direct conflict of interest given his substantial stock holdings in Anduril and the company's multi-billion-dollar contracts with the service.52

Case Study: The "Golden Dome" and Other Tailor-Made Projects

The "Golden Dome" missile defense system serves as a prime case study of how this political influence translates into massive, potentially self-dealing projects. Proposed by President Trump shortly after taking office, this ambitious system is envisioned as a comprehensive shield against missile attacks, relying heavily on a network of space-based sensors and interceptors.5 A joint bid from SpaceX (led by Elon Musk), Palantir (Thiel), and Anduril (Luckey) quickly emerged as the "frontrunner" for the core contracts.5

Continue reading here (due to post length constraints): https://p4sc4l.substack.com/p/a-powerful-cohort-of-silicon-valley